Beginning January 1, 2024, reporting companies are required to file reports with the Treasury Departments Financial Crimes Enforcement Network (FinCEN) that identify: (i) the beneficial owners of the reporting company; and (ii) for those entities formed on or after January 1, 2024, individuals who have filed an application with state or tribal agencies to form the entity or register such reporting company to do business in the United States. Of critical importance is that this reporting obligation applies to entities in existence before January 1, 2024, and to those entities created or registered on or after January 1, 2024.

For those entities created or registered before January 1, 2024, the deadline to file an initial report with FinCEN is January 1, 2025. For those entities created or registered on or after January 1, 2024 and before January 1, 2025, the deadline to file an initial report with FinCEN is 90 days after the reporting company receives actual notice that its creation or registration is effective or after a secretary of state or similar office first provides public notice of its creation or registration, whichever is earlier. For those entities created or registered on or after January 1, 2025, the deadline to file an initial report with FinCEN is 30 days after the reporting company receives actual notice that its creation or registration is effective or after a secretary of state or similar office first provides public notice of its creation or registration, whichever is earlier.

Who is a Beneficial Owner of a Reporting Company?

A beneficial owner of a reporting company is an individual: (i) who directly or indirectly exercises “substantial control” over the reporting company; or (ii) who directly or indirectly owns or controls 25 percent or more of the “ownership interests” of the reporting company.

Substantial control depends on the power the individual may exercise over a reporting company and includes any senior officer of a reporting company, an individual with authority over the appointment or removal of any senior officer or dominant majority of the board of directors (or similar body) of a reporting company and an individual that directs, determines, or decides, or has substantial influence over important matters of a reporting company. The rules and regulations are non-exhaustive so determination of individuals with substantial control will need to be determined on a case-by-case basis.

As with determining individuals with substantial control over a reporting company, determining ownership interest will also be determined on a case-by-case basis and is not limited to simple record holders of equity interests and includes those holding profit interests, convertible instruments, warrants or rights, or other options or privileges to acquire equity, capital, or other interests in the reporting company.

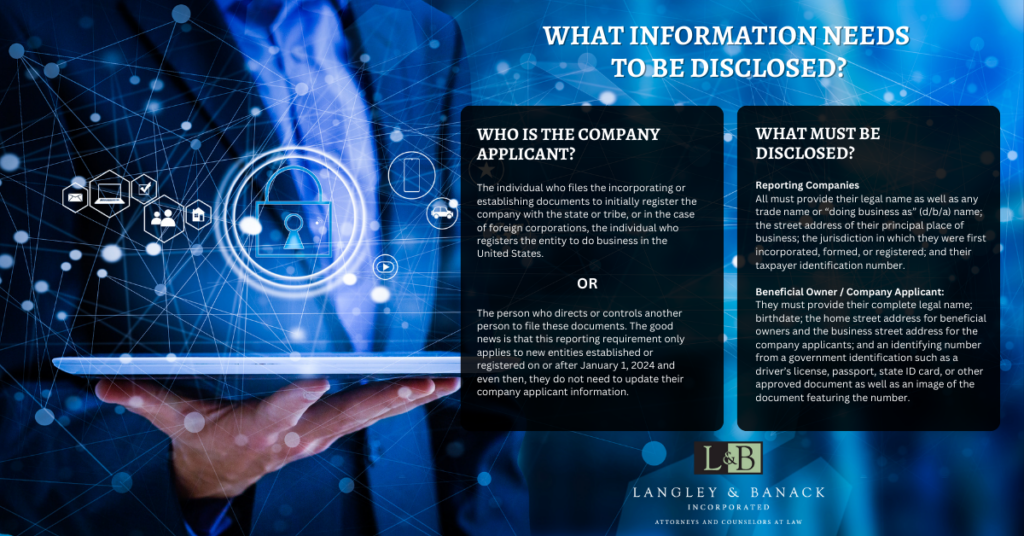

Who are the Company Applicants of a Reporting Company?

CTA has narrowed the definition of a company applicant to the following:

(i) The individual who directly files the document that creates, or first registers, the reporting company; and

(ii) The individual that is primarily responsible for directing or controlling the filing

of the relevant document.

No more than two (2) individuals will be a company applicant. Therefore, an attorney or paralegal preparing and filing documents on behalf of a reporting company may be included as a company applicant of a reporting company.

What Must Be Disclosed by a Reporting Company?

Each reporting company must provide the following information about the company:

(i) Legal name of the company;

(ii) assumed name;

(iii) current street address of its principal place of business in the United States, or, for reporting companies whose principal place of business it outside the United States, the current address from which the company conducts business in the United States (no PO Box or address of formation agent);

(iv) jurisdiction of formation or registration; and

(v) unique identification number (EIN / TIN).

Each reporting company must provide the following information about each beneficial owner:

(i) The individual’s name, date of birth and residential address;

(ii) A unique identifying number from an acceptable identification document; and

(iii) The name of the state or jurisdiction that issued the identification document.

Each reporting company formed on or after January 1, 2024 must provide the following information about each company applicant:

(i) The individual’s name, date of birth and address;

(ii) A unique identifying number from an acceptable identification document; and

(iii) The name of the state or jurisdiction that issued the identification document.

If the company applicant is in the business of corporate formation (e.g., attorney) and files the formation or registration document in the course of that business, then the reporting company must report the current street address of the company applicant’s business; otherwise, the company must report the company applicant’s residential address.

Acceptable forms of identification include a non-expired driver’s license issued by a U.S. state, a non-expired identification document issued by a U.S. state or local government or Indian Tribe that is issued for purposes of identifying the individual, a non-expired passport issued by the U.S. government, or, if the individual does not have any of the foregoing, the reporting company may provide the identifying number from a non-expired passport issued by a foreign government. The reporting company must submit an image of the identification document associated with the unique identifying number reported to FinCEN.

FinCEN will make unique identifier’s available to reporting companies, beneficial owners and company applicants so that personal information does not need to be disclosed to third parties, but recipients must update their records if there are any changes to reported information.