Beneficial Ownership Disclosure Starts January 1, 2024

Starting January 1, 2024, pursuant to the Corporate Transparency Act, with certain limited exceptions, corporations, limited liability companies, limited partnerships and any entity that is created, or registered to do business, in the United States must begin to disclose specific information about its beneficial owners and company applicants to the Treasury Department’s Financial Crimes Enforcement Network (FinCEN). Non-compliance may be subject to civil and criminal penalties. The reported information will be compiled in a national database and used by authorized government agencies, some financial institutions and certain other authorized users. Reported information is not supposed to be made publicly available.

What is the Purpose of the Corporate Transparency Act?

As little, if any, information is maintained with respect to beneficial owners of business entities in the United States, it is currently difficult to limit, deter or prevent wrongdoers from utilizing U.S. businesses for illicit purposes. The purpose of the bipartisan Corporate Transparency Act (CTA) is to prevent these wrongdoers from exploiting U.S. entities for criminal gain, and to assist law enforcement in detecting, preventing and punishing terrorism, money laundering and other misconduct.

With the CTA, Congress has bypassed state legislatures and tribal authorities to have the beneficial ownership and company applicant information of reporting entities reported directly to the federal government through FinCEN. While the CTA was passed in 2020, Congress built in a waiting period to allow FinCEN time to promulgate rules to implement the legislation. FinCEN completed this process in September 2022 and set an effective date of January 1, 2024 for the new rules to take effect.

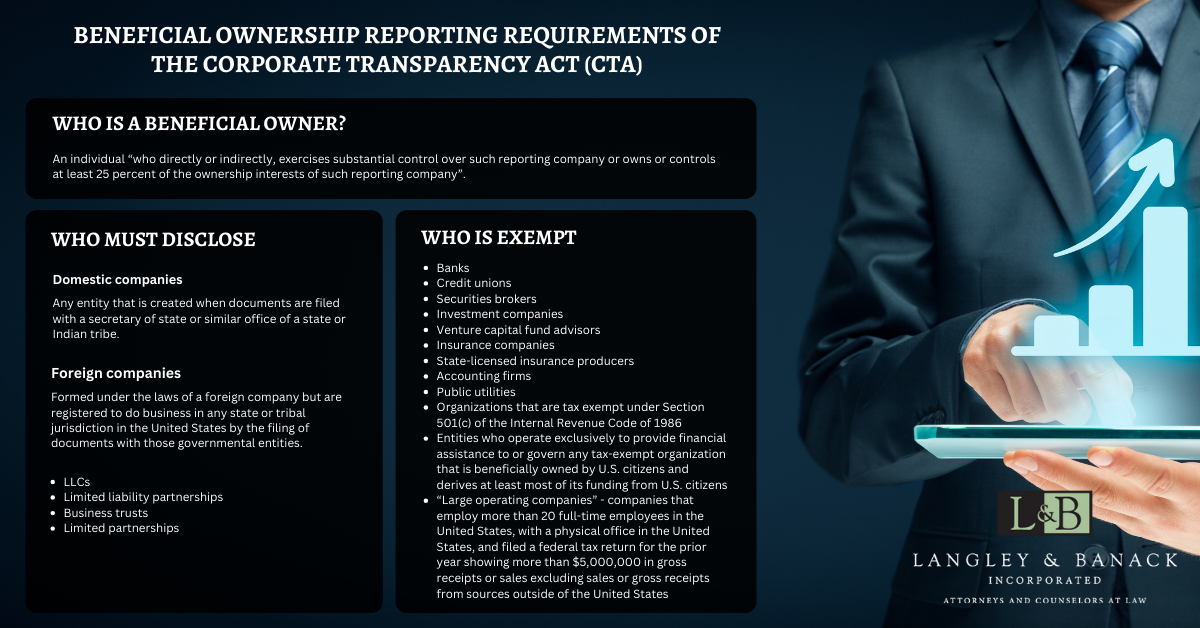

What Entities Does CTA Apply To?

CTA separates reporting companies into two categories: foreign and domestic. A domestic reporting company is any entity that is created by the filing of a documents with a secretary of state or similar office under the law of a state or Indian tribe. A foreign reporting company is any entity that is an entity formed under the law of a foreign country and registered to do business in any U.S. state or in any Tribal jurisdiction by the filing of a document with a secretary of state or similar office under the law of a U.S. state or Indian tribe. A “state” includes any state of the United States, the District of Columbia, and any other commonwealth, territory, or possession of the United States.

What Entities are Exempt from CTA?

The proposed final rules exempt 23 types of entities from the beneficial ownership information reporting requirements. See Proposed 31 CFR 1010.380(c)(2). Most of these exempt entities are entities that are already regulated by the federal and/or state governments and already disclose their beneficial ownership information to a governmental authority such as banks, credit unions, securities brokers, investment companies, insurance companies, accounting firms and public utilities. One exemption that may be available to an entity that may not otherwise be presently reporting to a governmental authority are those companies with at least 20 full-time employees, more than $5,000,000 in gross receipts or sales, and an operating presence at a physical location within the United States. Unfortunately, these exemptions do not cover many small businesses and holding companies and therefore CTA will apply to many entities.